All MTD PCB calculation have to be done online using PCB calculator payroll system or LHDNs own e-PCB system. Kemudahan e-filing membolehkan penyerahan dan pengisian borang ini dilakukan secara online sahaja.

Prosedur ini tidak terpakai kepada pembayar cukai yang membuat e-Filing melalui Ejen Cukai.

. You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS. Youre eligible for an automatic tax deduction of RM9000 just by filling in the LHDN e-Filing form. After filing retain a copy of the forms for your records.

Anda boleh mula login ke dalam sistem e-Filing LHDN bagi mengisi borang dengan lengkap dan menghantar kepada LHDN. Once the new page has loaded click on the relevant income tax form for the year. Further education fees self.

Panduan lengkap cara isi borang eFiling e-Filing LHDN langkah demi langkah. Melayu Malaysia MYTAX Content. Dan anda perlukan sedikit rujukan agar proses tersebut berjalan lancar.

Melayu Malaysia MYTAX Content. Self parents and spouse 1. Untuk makluman anda juga pastikan anda selesaikan urusan E Filing Income Tax ini dalam masa yang telah ditetapkan.

Taken directly from the LHDN website it is cited that referring to Section 831A Income Tax Act 1967 that every. Anda mahu isi borang eFiling secara online di laman web LHDN ezHasil. You may also update below details by.

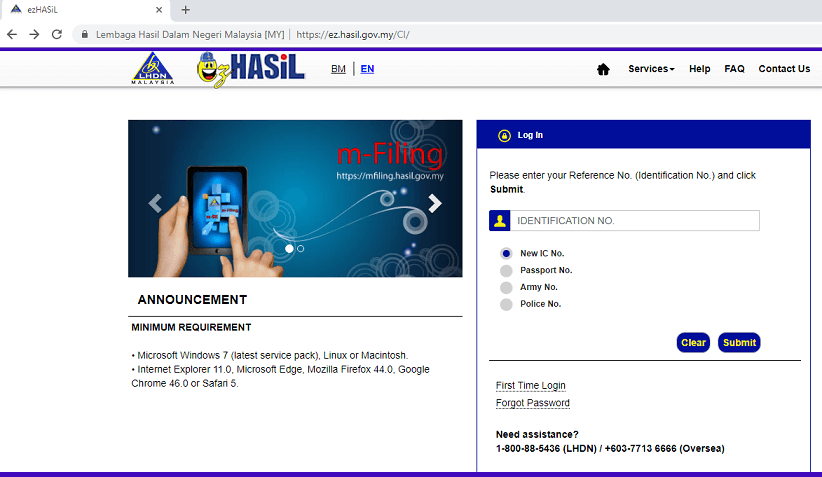

To kickstart the process of registering as a taxpayer head on over to the LHDNs e-Daftar website where you can conveniently carry out the process onlineYoull need to upload a digital copy of your IC to serve as supporting document so it would be a good idea to prepare that beforehand. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. With UOB YOLO Visa you will not be going to miss out on the latest food and online trends anymore.

Pembayar cukai boleh mengemukakan memfailkan Borang Nyata Cukai Pendapatan BNCP secara online melalui e-Filing atau secara manual. The reason you need this is to ensure that if you are above the paygrade that requires you to pay taxes the form ensures that you are aware of this and this is the form you use when you go online and do your E-Filing. Salaries wages allowance incentives etc to be included in the CP8D form.

Important things to take note about filing Form E. As the name suggests this will be done automatically by the system. This option may vary depending on what type of income tax you are filing and you can refer to this table to help you figure out what to look for.

Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. If your email address registered with LHDN browse to ezHASiL e-Filing website and click PIN Number Application. Apa kata lepas ni kalau terima emel surat atau panggilan telefon dari LHDN atau dari scammer yang menyamar LHDN anda semak dulu status percukaian di.

If youre registering for e-Filing for the first time youll need a one-time login 16-digit PIN provided by LHDN. Now that youve registered as a taxpayer youll need to register for e-Filing on the ezHASiL platform. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut.

FRASA KESELAMATAN Mulai 27 Februari 2017 LHDNM akan meningkatkan keselamatan laman sesawang ezHASiL dengan memperkenalkan frasa keselamatan. E-Filing Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. You only need to make a minimum spending amount in a month on the Online Dining and Contactless categories combined to earn 5 cashback capped at RM30 a month.

Use e-Daftar and register as a taxpayer online. Untuk yang baru bekerja atau baru memulakan perniagaan ini cara daftar LHDN pertama kali sebagai sebelum memulakan e-filing. Tarikh akhir pengemukaan BNCP ialah 30 April untuk individu yang tiada punca pendapatan perniagaan - Borang BEe-BE dan 30 Jun untuk individu yang ada punca pendapatan perniagaan - Borang Be-B setiap tahun.

Semakan tunggakan cukai lhdn sekatan perjalanan Ramai pulak yang call dan wasap beritahu ada terima panggilan scammer dan e-mel peringatan daripada pihak yang menyamar sebagai LHDN. You can get it from the nearest LHDN branch office or apply online via the LHDN Customer Feedback website. Click on the menu ezHasil services menu on the left-hand side of the screen then select e-filing.

IRB no longer accepts manual forms. Ia bukan saja menjadi tanggungjawab kita sebagai rakyat Malaysia sebenarnya daripada pengisytiharan cukai kita di LHDN juga institusi kewangan mudah untuk membuat perhitungan dan meluluskan pinjaman bank. Sebarang kelewatan atau tidak melakukan E Filing ini akan menyebabkan anda sebagai pembayar cukai akan dikenakan penalti jika terdapat cukai yang.

If you email address not registered with LHDN you have to fill up Online Feedback Form to obtain PIN Number. Please note that the minimum amount of each transaction is RM15. Submission via Customer Feedback Form or email is NOT ALLOWED and will not be processed.

Bagi cukai taksiran tahun 2020 kini e-filing dibuka pada 1 Mac 2021 ini. Tidak kira kali pertama isi atau sudah berkali-kali Post ini dicipta khas untuk tujuan tersebut. You dont need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return.

Frasa keselamatan adalah bertujuan. With effect from 1 st July 2022 change of address can only be made through Notification of Change in Address Form CP600B Pin 12022 and accepted either submitted by hand or by post or update online via e-Kemaskini only. All Right Reserved e-Apps Unit Department of e-Services Application Inland Revenue Board of Malaysia.

Select Accounts Banking then select Bill Payment. Most recomended using IE Browser. How to make a LHDN payment.

E - Janji Temu. E Filing ini boleh di isi melalui Laman Web Rasmi LHDN iaitu di Portal ezHAZIL. Employees remuneration informationie.

With that heres LHDNs full list of tax reliefs for YA 2021. E - Janji Temu.

Lhdn E Filing Your Way Through Tax Season Properly

Income Tax Relief For Lhdn E Filing 2022 Ya 2021 Joy N Escapade

Steps To Apply E Pin Online L Co

How To File Income Tax In Malaysia 2022 Lhdn Youtube

How To Apply Pin No During Mco Yau Co

Semak Online E Filing Lhdn 2020 Apps On Google Play

Steps To Apply E Pin Online L Co

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

First Time Income Tax Registration Get E Pin Number Online How To Register Your Income Tax Account For First Time 𝐇𝐨𝐰 𝐭𝐨 𝐠𝐞𝐭 𝐲𝐨𝐮𝐫 𝐫𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐞 𝐩𝐢𝐧 𝐧𝐮𝐦𝐛𝐞𝐫 𝐨𝐧𝐥𝐢𝐧𝐞 𝐰𝐢𝐭𝐡𝐨𝐮𝐭 𝐠𝐨𝐢𝐧𝐠 𝐭𝐨 𝐚

Ezhasil E Filing Login Account Pin Number Digital Certificate Application For Organization The Research Files

How To Reset Lhdn E Filing Password The Money Magnet

Ultimos Trabajos Diseno E Impresion De Talonarios De Recibos Para Distribuidora Hudson