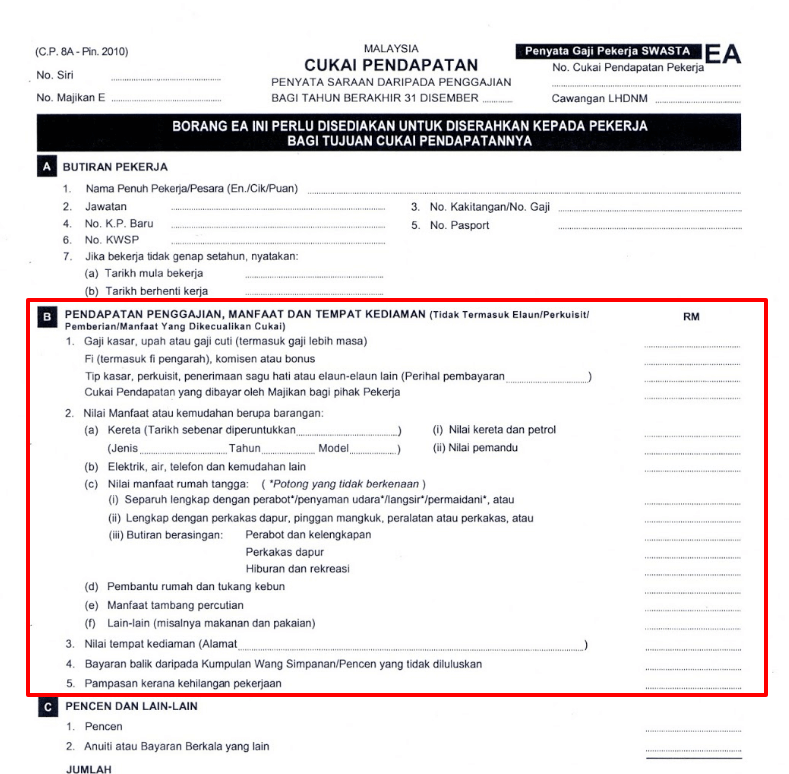

If approved you are required to complete. Income tax return for partnership.

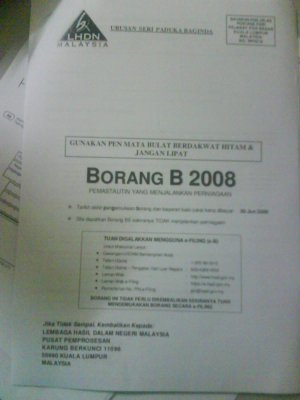

Borang B Cukai Pendapatan Your Tax We Care

How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time.

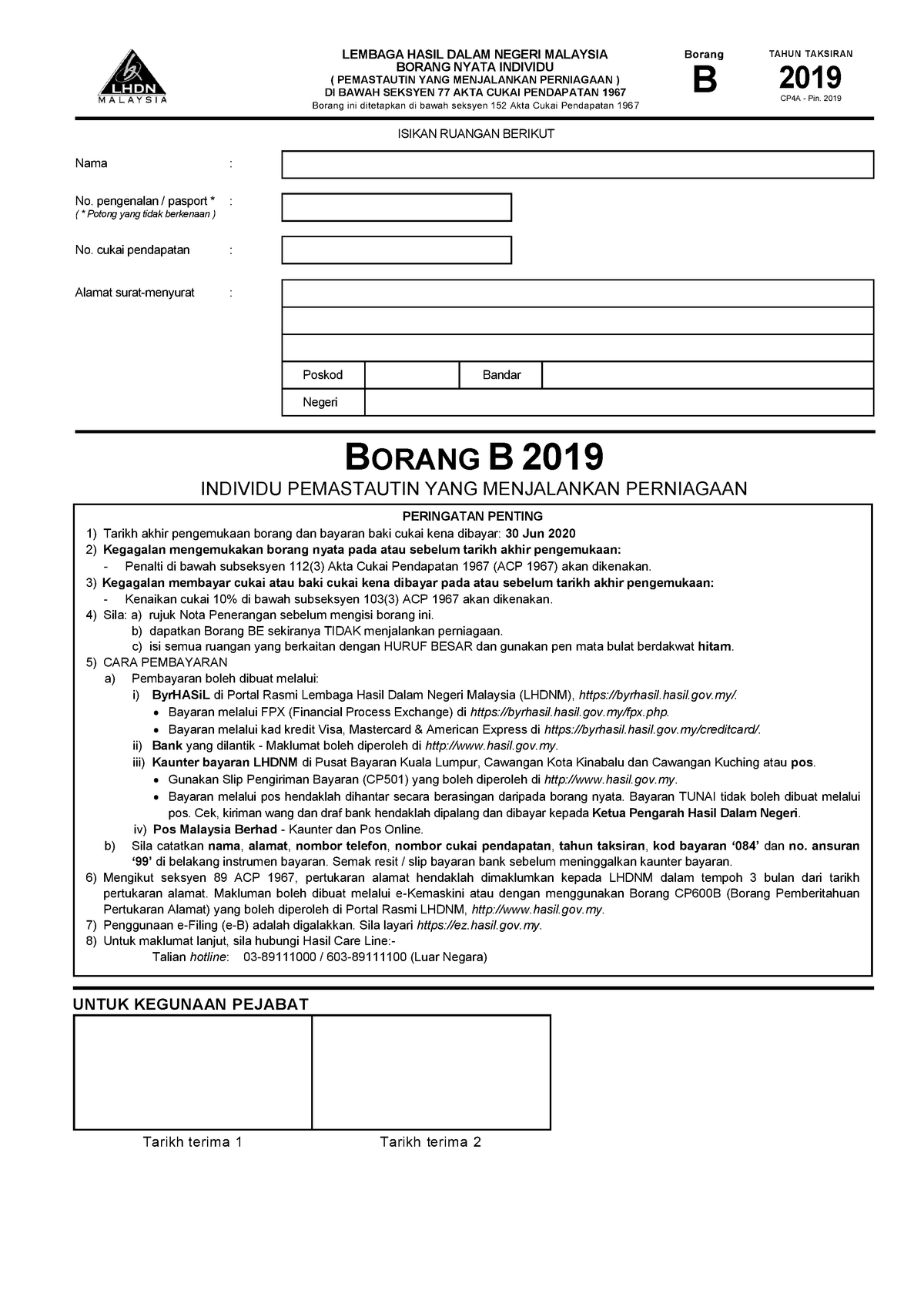

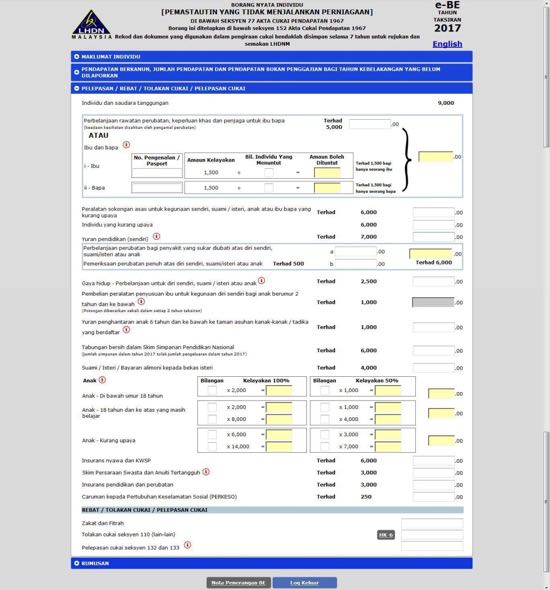

. What would be the action taken by IRBM when the income declared in the Form B is lower compared. On the First 5000 Next 15000. B dapatkan Borang BE sekiranya TIDAK menjalankan perniagaan.

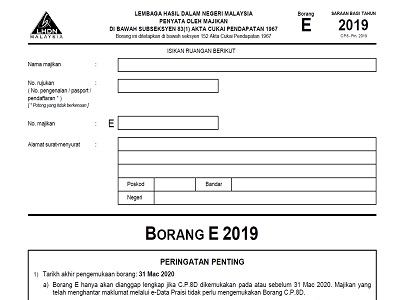

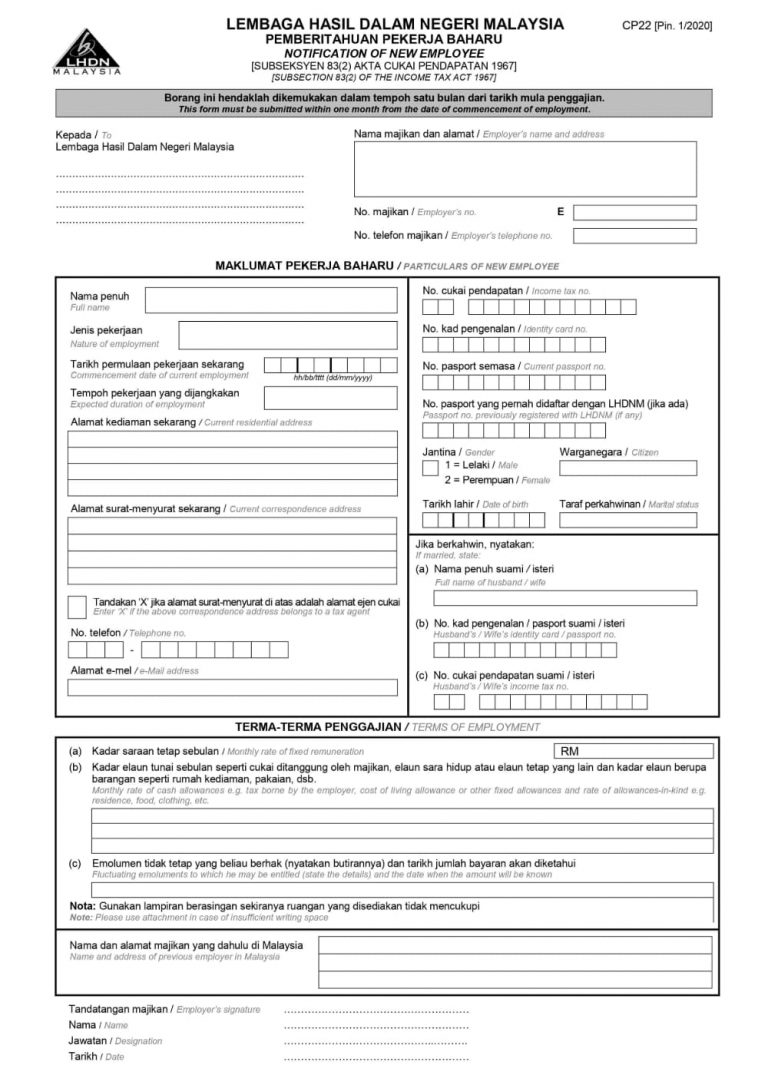

Completed should be submitted to the IRBM branch handling your income tax file. Contribute to listianiana8diraya development by creating an account on GitHub. IRB Branch E- PARTTAXPAYERS PERSONAL PARTICULARS REFER NOTE SELF Male Borang yang ditetapkan di bawah.

If you are required to file a return a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. Income Tax File No. Employers Income Tax File No.

Find a Dedicated Financial Advisor Now. Technically tax brackets end at 123 and there is a 1 tax on personal income over 1 million. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

Single tax filers who earn up to 75000 or joint filers who report as much 150000 individuals with. 请问我要怎么知道我已经Register Income Tax 呢 我有收到cukai pendapatan的来信但是我要在login的时候却忘记密码当我按Forgot Password再输入我的IC号码却显. Ive also included some of t.

You must pay income tax on all types of income including income from your business or profession employment dividends. PF payment due dates for the FY 2021-22 for the purpose of tax audit reporting Reporting under clause 20 b of Form 3CD requires due dates of payment to various. Here are 5 tips every Sole Proprietors in Malaysia need to know while filing your Borang B to get the most out of your business.

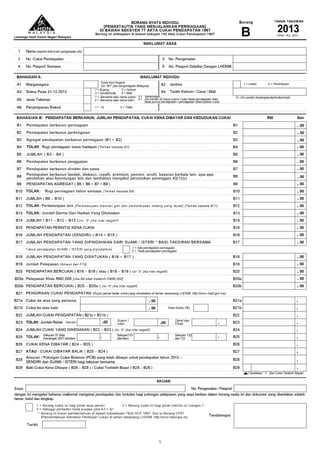

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions. Income Tax Borang B Jaycectzx Tax Deduction MTD purposes. Calculations RM Rate TaxRM A.

The plan provides refunds on a sliding scale based on three income levels. Whenever the gross rental income from all locations in the City is less than 20000 per calendar year a Tax Registration Certificate is not required or a tax is not due. You must be wondering how to start filing income tax for the.

On the First 5000. 1 Joint in the name of husband 2 Joint in the name of wife 3 Separate 4 Self whose spouse has no income no source of income or has tax exempt income 5 Self Single. As part of the Mental Health Services Act this tax provides funding for mental.

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021

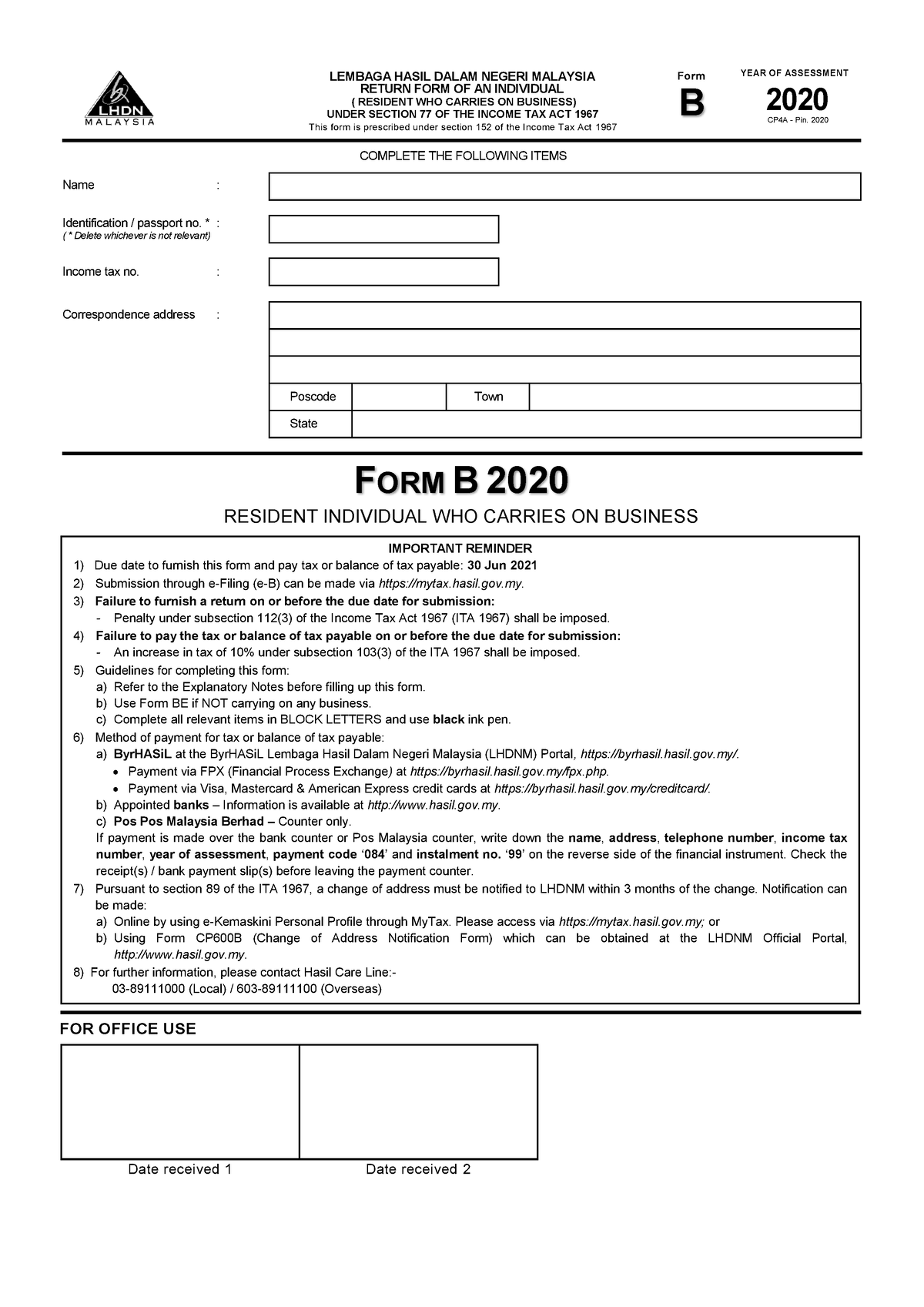

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Cara Isi E Filing Lhdn Untuk 2020 2021 Panduan Lengkap

Borang B 2019 1 Tax Borang B 2019 Individu Pemastautin Yang Menjalankan Perniagaan Tarikh Terima Studocu

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

Form E B 2020 Example Of Form E B Form B 2020 Resident Individual Who Carries On Business 20 20 Studocu

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

My First Time With Income Tax E Filing For Lhdn Namran Hussin

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll